|

The Green Flower Marketing Cooperative adopts the management mode of a true cooperative, mainly to serve the farmers and without any profit-seeking behavior. All working capitals are handled sorely by the farmers themselves. The ins and outs of all funds are directly going into the members’ accounts.

-

Production and sales revenues and expenditure should be detailed accounted.

-

Investment analysis should be done before purchasing large equipment.

-

Financial analysis should be exacted, seeking opportunity to reduce costs.

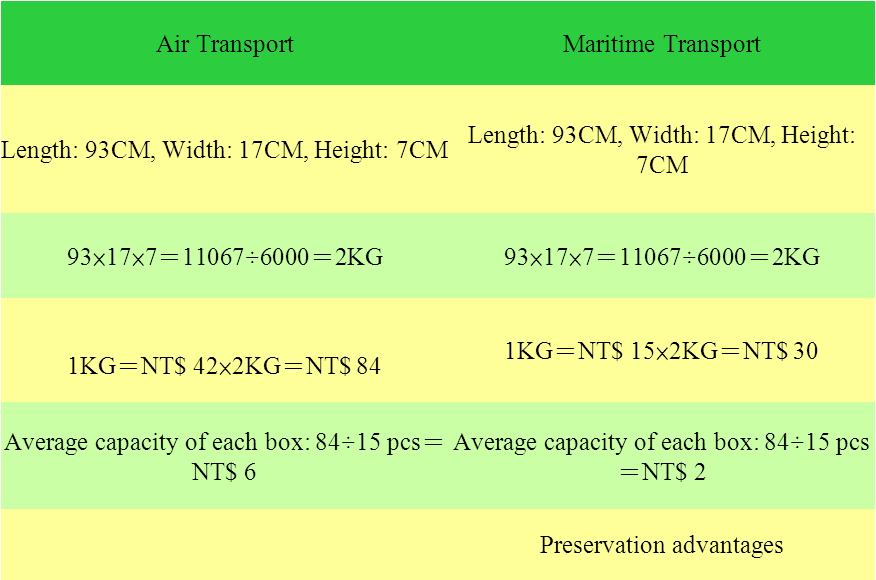

Table 1-5 Transportation Costs Analysis

Source of information: The Green Flower Marketing Cooperative

In the field of anthurium refined agriculture, its returns (or cost-profit ratio) are relatively high. If the industry is enterprise managed, the profitability and stability will be better.

Table 1-6 Scale of Operation and Profitability Analysis

Items |

Analysis |

The ratio of fixed assets to total assets |

1:1 |

The ratio of costs of production and marketing costs |

3:1 |

Investment returns |

60% |

Scale operation |

Around 21 hectares cultivation area |

Plantation per hectare |

65,000 pcs |

65000x21=1,365,000 pcs |

Yearly yield per hectare |

320,000 pcs |

320000x21 pcs=6,720,000 pcs |

Profit from each flower |

NT$ 6 |

NT$ 6 x6,720,000 pcs

=NT$ 40,320,000 |

Costs-reduction due to maritime preservation advantages |

(6,720,000 pcs×85%÷15pcs)×(6-2)=NT$ 1,523,200 |

Source of information: The Green Flower Marketing Cooperative |